A Checklist To Streamline the Payroll Process

Calculating the total remuneration for each employee is a tedious task in payroll processing.

Although it may seem simple with this brief explanation, it is not.

For example, a company policy that explains benefits and leaves.

Defining the components of payslips such as basic pay and HRA.

Collecting time-sheet data as well as other payroll inputs such overtime, travel expenses, and so forth.

Collect information from various departments, e.g., Any due pending that must be recovered from employees.

Calculating the payable salary after taking both statutory and non-statutory deductions

Salary increases for employees

TDS, PF and other dues can be deposited at the appropriate authorities

Each step can be furthered by adding additional steps.

To collect payroll input, for example, you might contact other departments to request information about employees such as travel expenses and overtime. You will then need to make sure it is all sorted out and that it doesn’t go wrong by doing cross-checking.

Other than the above, it is important to update the payroll information. This includes one-time payments and deductions.

It is easy to see that if your payroll team relies on manual methods of payroll, it can take a long time and be tedious. You cannot guarantee that your payroll will be error-free.

This blog will provide a checklist that will streamline your payroll process. It will save you time and help you avoid mistakes.

Checklist to Streamline the Payroll Process

There are three phases to the payroll process: Pre-payroll (payroll), payroll (payroll), and post-payroll.

Pre-payroll list

To set up payroll

To streamline your payroll flow, payroll setup is an important step in the payroll process. The process of setting up payroll can differ depending on where you are located. You must be familiar with Indian labor laws and compliances if you are hiring Indian employees. The list of payroll setup documents may vary depending on the country.

If you’re a U.S.-based business, the following documents will be required to establish payroll.

Employer Identification Number

Number of taxes collected by the state and local governments

Information about employee tax (Form W-4 for full-time workers)

Federal and state withholding account

Collect new employees’ information

Full Name

Address

Category of employee (full-time, contractor)

Social security number

Information about employee tax withholding from Form W-4

Details about salary and benefits

Bank details

To verify eligibility for work in the U.S., fill out Form I-9

To access the current payroll system

You can streamline your existing payroll system

Revision of the payroll policy and updating

Payroll policies, such as the pay policy, benefits policy and attendance policy, all have an impact on payroll calculation. Payroll processes can be kept running by having a clear and concise payroll policy that is approved by the higher management.

It is not an easy task. Any change in the labor law of a country or company’s internal policies can have an impact on payroll policy. Therefore, you might need to update it every few months, or even years.

Select an automated payroll system

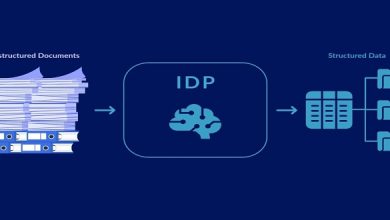

Automated payroll systems can be used to streamline your payroll process. Automated payroll systems integrate data and automatically process payroll accurately without any delays.

According to a study, 49% US workers will look for new jobs if they are not paid their paychecks on time.

Employee turnover is increased by miscalculations and delays. This can lead to unhappy employees, tax errors and even fines from the government.

You may not have to follow this checklist if you use an automated system. Your payroll software will reduce the number of steps.

Automate employee enrollment

For large numbers of employees, you can automate employee enrollments in payroll to ensure that there are no errors. Manual processes are more laborious and can lead to errors and time delays. You can also enable automatic status updates like promotion, interdepartmental shifts and so on.

Streamline data collection for employees from different departments

It takes a lot of time to collect information from different departments, such as attendance sheets and salary revision data. This involves a lot back and forth conversations. Payroll systems that have automatic integration features, such as the employee self-service portal, leave management and time-sheet management, can cut down on this.

To process payroll for employees already employed, you will need the following data.

Updates on Salary and Deduction

Updates on Benefits

Attendance entries

Missed punches

Vacation and sick leave

Time adjustments

Payroll adjustments, such as overtime, bonus, commission, bonus correction, reimbursement, advance and final payments for terminated workers

Validate the data

After you have collected the data, merge it and verify it according to the payroll policy. It is important to make sure you don’t miss any details necessary to process payroll.

Payroll Checklist

Payroll Schedule

Payroll that is done weekly or biweekly will take up more time and be more expensive. It is a great way to reduce the time and cost of payroll. This may not be possible for contractors or freelancers but you can still choose a fixed date.

Segregate Payroll Calculation according to employment type

The payroll calculation would be done separately depending on the type of employees. Tax deductions will differ for contractors and full-time workers.

Payroll calculation

After validating the data and segregating employees you will need to calculate your net payable amount after accounting for overtime, tax deductions, and reimbursements.

Payment method

To keep your employees happy, it is important to choose the best and easiest way to transfer salary. Sometimes, employees are annoyed by cash and paychecks payments. Online bank transfer is fast and the most secure way to transfer your salary.

Post-payroll list

Statutory compliance

You must submit any statutory deductions, such as TDS, ESI or any other tax, to the appropriate government department according to regulations.

Payroll accounting

To keep track of all payroll transactions, you can use either an ERP system or account books.

Payslips from

Some countries make it mandatory for employees to have payslips. It is a good practice, even though it isn’t mandatory. Payslips should include information such as name and address, employee ID, bank account number, salary paid, deductions etc. Employees can request their salary slips using payroll management software.